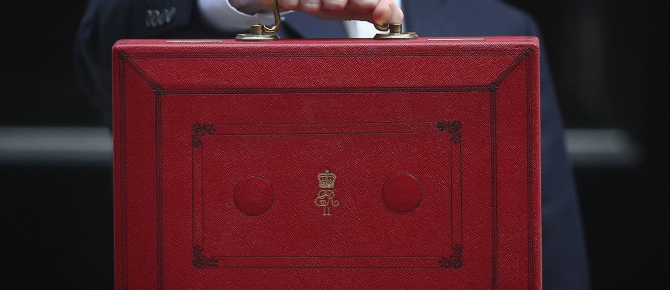

Spring Budget Summary – What’s the impact for Business?

**Business**

– £435m for firms affected by increases in business rates, including £300m hardship fund for worst hit.

– Pubs with rateable value of less than £100,000 to get a one-year £1,000 discount on rates they would have paid.

– Rate rises for businesses losing existing relief will be capped at £50 a month.

– A £820m tax avoidance clampdown, including action to stop businesses converting capital losses into trading losses and introduction of UK VAT on roaming telecoms services outside the EU.

– Privately-owned SMEs to get extra year to prepare for tax digitisation and quarterly reporting.

**Personal taxation**

– The main rate of Class 4 National Insurance contributions for the self-employed to increase from 9% to 10% in April 2018 and 11% in April 2019.

– The increases, applying to earnings between £8,060 and £43,000, will raise £145m a year by 2021-22 at an average cost of 60p a week to those affected. All Class 4 earnings above £43,000 will continue to be taxed at 2% while those below £8,060 will pay nothing.

– Class 2 National Insurance, a separate flat rate contribution paid by self-employed workers making a profit of more than £5,965 a year, is to be scrapped as planned in April 2018.

– Taken together, millions of self-employed workers could pay an average of £240 a year more but ministers say those earning £16,250 or less will pay less.

– No changes to National Insurance paid by the employed and employers or to income tax or VAT.

– Personal tax-free allowance to rise as planned to £11,500 this year and to £12,500 by 2020.

**The state of the economy**

– UK second-fastest growing economy in the G7 in 2016.

– Growth forecast for 2017 upgraded from 1.4% to 2%.

– GDP downgraded to 1.6%, 1.7%, 1.9% in subsequent years, then 2% in 2021-22.

– Annual rate of inflation forecast to rise from 2.3% to 2.4% in 2017-18 before falling to 2.3% and 2.0% in subsequent years

A further 650,000 people expected to be in employment by 2021.

**Shareholders**

Director shareholders will see a tax break reduced on the dividends they receive.

The tax-free dividend allowance – which only came into force a year ago – will be reduced from £5,000 to £2,000 from April 2018. That will affect those who own a small business and pay themselves in dividends alongside a small salary. It will also hit people with large portfolios of shares.

Experts say that with an Isa allowance of £20,000 available to use from April, many investors will not need to worry.

**Read further reactions from:**

[British Chambers of Commerce](http://www.britishchambers.org.uk/press-office/press-releases/british-chambers-of-commerce-initial-reaction-to-spring-budget-2017.html)

[Institute of Directors](https://www.iod.com/news-campaigns/news/articles/Chancellors-nothing-to-see-here-approach-will-only-fly-for-so-long)

[British Retail Consortium](http://brc.org.uk/news/2017/brcs-reaction-to-the-spring-budget)